What does the Future of Fintech hold?

Maxcode’s Chief Business Development Officer, Liesbeth Becker Hoff discusses top Fintech trends

As it transitions from a disruptive tech trend to a mainstream industry, Fintech is gaining significant ground among digital users. A recent survey shows that 15.5% of digitally active consumers have used at least two Fintech products within the last six months. As awareness of the available products and services increases, adoption rates are expected to double within the year.

Harnessing technology to deliver value and convenience, forward-thinking financial institutions are putting customers first and developing products and services to retain them.

Liesbeth, Chief Business Development Officer at Maxcode, gives an input on what the future holds for the Fintech industry and what are the trends that companies should be preparing for:

How do you see the Fintech sector today?

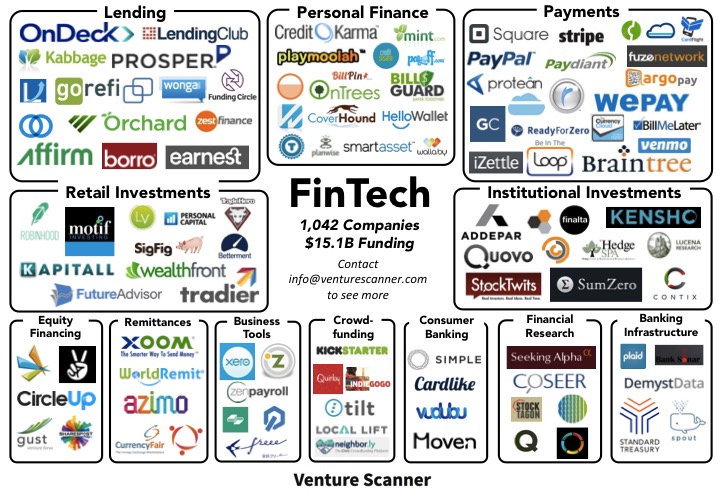

Fintech remains a prolific industry, regardless of the tough regulations. It has generated more than 17 different subcategories and has seen 1000s of companies being created in the last years.

Just a quick look at these subcategories and you’ll find anything from highly niched areas as financial research tools or equity investment platforms, to broader areas such as payments or business management tools.

What is interesting is the specialization and vertical drive that each category takes. While there are a number of companies building more generic products and services, there is a path towards dissecting the financial industry into small segments, decentralizing it, rebuilding it and innovating each area at a time.

What do you think are the next trends in financial software?

When trying to understand where a market will be in 10 years, there are simple things that make sense and others that involve higher risks. As we are actively involved in financial software development, we look at the main development tendencies that can have the potential to be disruptive, or that have passed the stage of early adopter buzz. These last ones, in particular, can develop into mature markets.

In terms of actual trends, predictive technology and big data are probably the first ones to come to mind. Blockchain and alternate currencies also have a potential to disrupt, however the risks associated with them are still high. Last but not least, mobile and wearables are already influencing money transfers, customer service and digital security, and are paving the way for digital identities to become an even bigger trend.

How do you see the impact of predictive analysis then?

Predictive analytics, user tracking and machine learning will allow financial institutions to develop automated processes for on-the-spot credit decisions, for example. This benefits both customers and the bank when, for example, a customer who is overextended on their credit card is given an automatic credit line extension and authorization (a machine-based decision), instead of facing an embarrassing decline when they cannot pay the restaurant bill.

It is definitely a game changer, as it allows financial organization to make use of data and payments behaviour to reduce decision times and bureaucracy, in this case.

Besides payments, you can develop financial concierges which could also use analytics to offer targeted loans and products, based on the customer’s past behaviour. That could mean financing the customer’s next vacation or car loan, when customer tracking shows that consumers are actively looking for these services or goods. The key is to use these technologies in a non-invasive manner, and focus on assisting and helping the customer, by remaining service-oriented and respecting their privacy.

For the SEPA members, Access-to-Account (XS2A) as part of PSD2 increases the possibilities to use accountholder’s information for analysis purposes. XS2A offers third party service providers (TPPs) to have access to (consumer and business) payment accounts when the accountholder provides explicit consent to do so.

PSD2 makes a distinction between two types of TPPs: payment initiation services providers (PISP) and account information service providers (AISP). Imagine what this might mean for large online retailers like Schwarz, Carrefour, Tesco, etc. They can facilitate their customers with all kinds of tailored financial services. This will boost the customer loyalty!

It would be interesting to see who will be the first to offer a dashboard with my different payment accounts, a new third party provider or a bank? Once it becomes more clear what different European banks demand regarding security and interfacing with their accountholder’s information, we at Maxcode are ready to develop these dashboards.

You mentioned digital identities as a trend, why is that relevant?

Digital identity solves the problem of fragmented identities. Bringing some cohesion to this issue will provide the banking sector with new opportunities, as well as new social responsibilities. This will impact how we relate to one another, how we do business transactions and even redefine the notion of trust.

What do you see as the main benefits of digital identities?

Mobile and epayments are common at this point. With the rise of these solutions, the requirement of secure and verifiable digital identities will become mandatory.

You see, we need to be able to verify online identities not only in banking and payments, but also when accessing sensitive information securely, such as medical records. The applications are extensive and a broad recognition is needed. As support and use of online and mobile financial services is rising, the demand for digital identification services will increase, making financial markets and consumers more likely to adopt the new payments model, rendering most transactions cashless. I do believe it is a great advantage that BVN launched iDIN in the Netherlands.

Maxcode already implemented iDIN within SURFnet, allowing their users to access information from universities or big corporates using their online internet banking as authentication.

Wearable payments made headlines for a while but the buzz has died down; Why do you think that is?

Every new industry has a buzz period followed by a maturity period when suddenly the technology itself is no longer that attractive but becomes mainstream, making it “affordable & needed”. From a strictly technological point of view, there are still important issues around the devices involved and around software interaction. Does a device rely on Bluetooth or NFC? Would a certain service only work with specific OS like Android? Etc.

The fact of the matter is that the costs involved are still high, if we consider the huge investment Disney made to embed wearables into their ecosystem with Magic Band. Wearable technology payments should integrate with as many platforms as possible. As the market develops, the cost of these solutions will drop, allowing more sustainable development efforts to be made.

Powering a wearable device with payment data is part of research and development from start-ups to banks. Replacing the chip and pin cards with fingerprint authentication on smartphones might not be very trustworthy just yet, but wearables have the advantage of diversity when it comes to implementation. Regardless of the form, wearables have a main advantage: they are always on, always available, frictionless devices. On the other side, the main challenge in the payments field is security and wearables are not yet seen as being secure. Consumers still feel more comfortable and safe using online payments or cards. The success rate will be highly dependent on a delicate balance between security (and the public’s perception of it) and the convenience it provides.

What else should be on the radar for industry startups and established companies alike?

If I were to choose, probably the API Economy would be it. This digital, automated exchange of business competencies allows organizations to integrate core services with one another, in order to develop and expand business cases and new markets. “Connect to stay ahead.” as you have to continuously evolve to enjoy and take advantage of the business opportunities from today’s markets. It is a growing economic force in today’s business environment but maybe not as visible sometimes. The concept has outgrown the software development meetings and reached the agenda of business strategy sessions and executive planning. API’s have been promoted from technology to business model lately which makes a lot of sense, but they are still missing from a lot of board room agendas. They certainly are worth considering.